New York Mayor Bill de Blasio launched his bid for president last week, amidst protests and jeers.

On Good Morning America, where he was having what should have been his first softball interview as a candidate, chants of “LIAR” could be heard from a rally outside the Times Square studio. The anti–de Blasio protest somehow united the local cop union and Black Lives Matter protestors, along with housing advocates and anti-poverty activists.

While New Yorkers greet de Blasio’s quixotic campaign with hostility or befuddlement, distant observers might wonder how this is more outrageous than, say, Beto O’Rourke or any number of red-state Democrats with thin records throwing away their shot at statewide office for similarly doomed runs at the White House.

Overlooked in all the grousing is Hizzoner’s actual achievements: Bill de Blasio is one of the best mayors that New York City has ever had. But he lacks that easygoing charm with voters (the kind that mainstream political commentators call “likability” when discussing women candidates). And his candidacy is a victim of the rising expectations of the resurgent progressive wing of the Democratic Party. Ironically, his own successful 2013 campaign for mayor—with its Occupy Wall Street–inspired “Tale of Two Cities” rhetoric—helped nurture a political climate that has rendered his race dead on arrival.

None of which is to say that being one of the city’s greatest head honchos is a particularly high bar. We’ve had mayors literally flee the country to avoid prosecution. But for the last half-century, almost every Big Apple mayor who managed to get re-elected left office with delusions of La Guardia–like status and presidential ambitions. De Blasio, by contrast, actually has progressive bona fides that ought to eclipse less-accomplished mayors like Pete Buttigieg and Julian Castro, who are also currently tilting at presidential windmills.

Take the singular achievement of de Blasio’s first term: the introduction of universal pre-K. Studies show that early-childhood education pays remarkable dividends in student achievement for years. And, as Katha Pollitt noted in a remarkable piece of advocacy in The New York Times, market-rate child care “is one of the biggest costs a family faces.” That expense averages $14,144 per child in New York, which can diminish both family wealth and women’s career progress for years.

When de Blasio launched a universal tuition-free pre-kindergarten program, he made a revolutionary improvement in the lives of 70,000 children and their families. His achievement was twofold: First, he found the money to fund it, establishing a massive program of wealth redistribution. Second, his administration mastered the logistical challenges of expanding the country’s largest public-education system by an entire grade level.

Under de Blasio, New York City did it in two years. Rather than take the extended victory lap that most politicians would for lesser achievements, de Blasio followed up by expanding the program by another grade level. Universal “3K”—preschool for three-year-olds—is in the pilot stage in neighborhoods around the city.

The older of my two kids turned three in January. She’ll be going to school tuition-free in September. Bill de Blasio saved my family approximately $56,546 over the next three years! That’s exactly the kind of “free stuff” politicking that Democrats can run on in 2020.

The de Blasio administration has served as an incubator of progressive policy, and not just his own. Freed from a Republican mayor who believed that the most important quality in a City Council Speaker is “keeping legislation that never should have made it to the floor … from ever getting there,” today the City Council often drafts the first versions of future congressional bills.

Just cause for terminations, banning urine tests, and criminal background checks for employment, and mandating paid vacations: These are just some of the reforms getting a dress rehearsal in New York before they become federal initiatives.

As free child care has become a signature issue of Elizabeth Warren’s presidential campaign, so too could any of these de Blasio reforms become national campaign issues.

The de Blasio administration also pioneered universal free lunches (without the stigma of means testing) in public schools, a fair workweek law, and round-the-clock service on the Staten Island Ferry. It curtailed the police department’s stop-and-frisk policy.

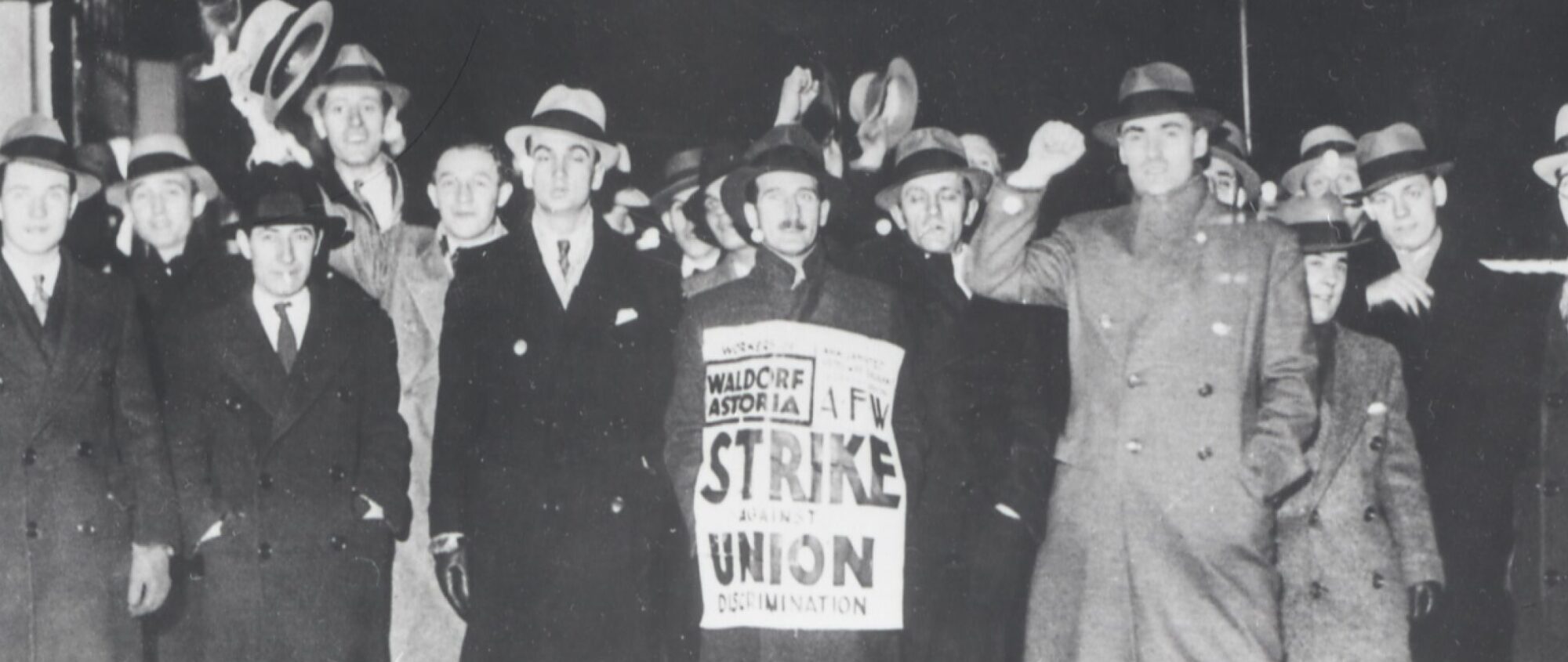

That last policy—combined with his balanced statement about the 2014 death of Eric Garner—provoked an unprecedented mutiny from the Police Benevolent Association. In the least effective job action in our country’s otherwise inspiring recent spike in strike activity, officers stopped ticketing for minor nuisances. Quality of life in the city briefly surged, while 80 percent of New Yorkers thought the union was “too extreme.” Still, de Blasio—who is the father of two mixed-race children and made racist police misconduct a signature issue in his first mayoral run—has mostly backed off from being critical of police actions. He’s remained sidelined on one of the major progressive causes of our time, the demands of the black community for respect and police accountability.

That the police officer who killed Eric Garner is only now facing a semblance of due process—five years after Garner’s killing and at the exact time that de Blasio is presenting himself as a progressive hero on the national stage—partly explains the left’s deafening yawn in response to his candidacy.

There’s also the subway system’s ongoing breakdown, which is not technically the mayor’s responsibility but is often uppermost in the mind of every sweaty, late-for-work straphanger who might rightly resent the mayor for not making this his new campaign. Then there’s the city’s public-housing authority, which is leaving its residents in such squalor that even the TrumpWhite House has to respond. And de Blasio’s failure to challenge entrenched real-estate interests has helped spin a tale of one city for the rich while the rest of us are moving to the boondocks because the rent is too damn high.

Compounding his failure to meet the heightened expectations of progressives, there’s also this: He’s a lousy retail politician. He lacks whatever that “it” is that makes voters like a pol. Being a jerk to a press corps that follows him around and hangs on his every word hasn’t helped either. A New York mayor who actually enjoys his job can hold court on a daily basis with dozens of reporters from around the world and advance his political philosophy and naked ambition. Or he can be defensive, brittle, and petulant and inspire those same reporters to dig a fresh grave for him every morning.

It’s not hard to look at the fawning media coverage of a small-town mayor who’s read a lot of books and an ex-congressman who lost an election to Ted Cruz and view de Blasio’s presidential campaign as an act of spite. If these punks get to set our national agenda, he’s probably thinking, why not me?

Term-limited as mayor, de Blasio has just two more years in City Hall. As a lame duck he has little power to whip votes for another landmark progressive victory, as he did for Councilman Brad Lander’s bill to require a “just cause” for discharging fast-food workers or Rafael L. Espinal Jr.’s bill to forbid bosses from making their employees check their work email after clocking out.

Basically, the mayor is bored. Campaigning for a new office is his way of making his daily rounds fun again. Besides, due in part to that deficit of likability, he lacks the political capital to contest either Senator Chuck Schumer or Governor Andrew Cuomo in 2022 Democratic primaries, though progressives clearly yearn for candidates to take them on. The Intercept has published fan fiction masquerading as speculative analysis about Alexandria Ocasio-Cortez getting redistricted out of her House seat so that she simply has to challenge Schumer. And the Working Families Party had to recruit a TV star to run against the vindictive and still unpopular Cuomo last year.

De Blasio is New York’s mayor because in 2013, no other left-winger thought it was possible to beat back the city’s developers and real-estate interests and whomever they would anoint to perpetuate Michael Bloomberg’s dubious legacy. Still, he was a long shot in 2013, too—until former City Council Speaker Christine Quinn’s and former Congressman Anthony Weiner’s campaigns both ran aground (for very different reasons). So who can blame the man for thinking he’s got a shot this time, too? But also, who can really blame him for finally taking a victory lap for having re-injected rich vs. poor rhetoric into Democratic politics—two years before Bernie Sanders first ran for president—and putting issues like universal pre-K on the national agenda?