[This article was co-authored with Moshe Marvit.]

You know what should be canceled? The legal right of most bosses to fire you for a “good cause, bad cause, or no cause.”

That status quo is so widely accepted that some progressives don’t think twice about appealing to the authoritarian power of bosses in the pursuit of social justice: Many high profile social media campaigns have been employed to get people who are caught on video committing racist acts in their everyday lives fired from their jobs. But the desire to hold racists and sexists accountable—or the related struggles against sexism, homophobia and fascism—need not be in conflict with the principles of workplace rights.

So-called “cancel culture” is not well-defined, but its critics frequently use the moniker to refer to an activist program of making individuals who harm their neighbors or coworkers with acts of racism, sexism (and worse) accountable through exposure and de-platforming—including attempts to get them fired. Liberal critics have been more likely to raise free speech concerns than any about workers’ rights, while leftists are likelier to argue that free speech doesn’t mean freedom from the consequences of speech.

Depending on what websites you read, “cancel culture” could be portrayed as the biggest threat to society outside of a pandemic with no end in sight, a cratering economy with tens of millions of people out of work and facing eviction, and unidentified men wearing camouflage and carrying machine guns removing protestors from the streets of Portland. The terms of the debate are so problematic that Trump used the occasion of his July 4 speech to complain of leftists that, “one of their political weapons is ‘cancel culture’—driving people from their jobs, shaming dissenters, and demanding total submission from anyone who disagrees.” Then, because the concept of irony has apparently died of complications from Covid-19, he continued, “This is the very definition of totalitarianism.”

Three years ago, we published an op-ed in the New York Times explaining how U.S. workers lack a basic right to their jobs that many workers in other countries enjoy as a legal standard. As a solution, we proposed a just cause “right to your job” law as a badly needed labor law reform. Since then, we’ve been encouraged to see the issue turn up on many progressives’ agenda.

In the debate between a right to your job and the need to de-platform bigots, some have raised concerns that without the boss’s right to fire an employee for any reason, racists and sexists would get more of a free pass at work. But this argument misses what “just cause” means. It doesn’t mean that employees cannot be fired, it means they can’t be fired for a reason that’s not related to work. Racism, sexism, harassment and other forms of conduct in and out of the workplace that make other employees feel unsafe and violate policies around respect and equity are grounds for discipline and termination—but are also subject to due process. When you look at how “just cause” plays out in areas where it exists—in the public sector, under many union contracts, or in other countries—it’s clear that racists, sexists and harassers are, in fact, disciplined.

Beyond the pale and unacceptable

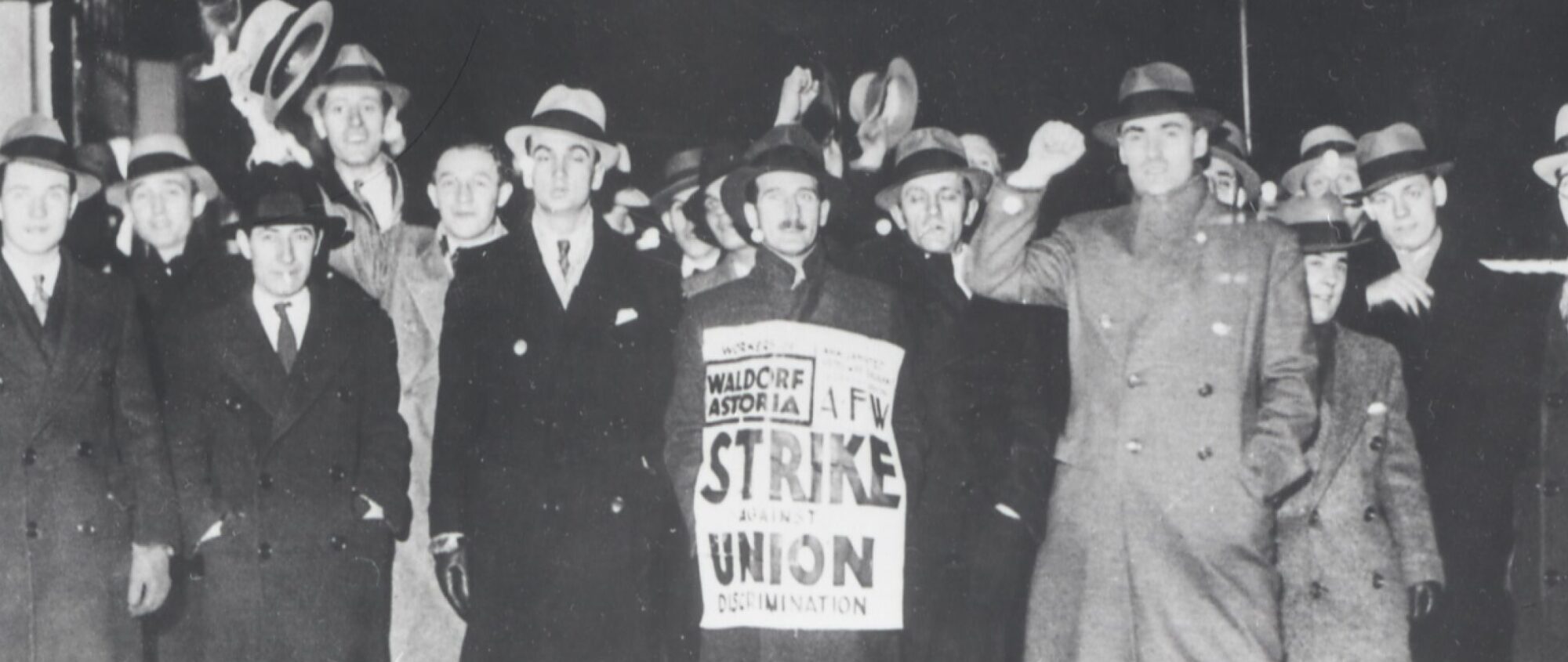

American workers stand apart from those in other countries, as they’re governed by a body of judge-made law called the “at-will” employment doctrine. The doctrine is built around a sort of false mutuality, where the employee has the “liberty” to quit her job for any reason, and the employer has the right to fire her for any reason. The alternative, commonly negotiated in union contracts, is “just cause”: the principle that an employee can be fired only for a legitimate, serious, work-performance reason. In a union contract—where “just cause” is commonly found—it is usually combined with a progressive discipline system and a grievance procedure to challenge write-ups, suspensions and terminations that a worker feels was unfair.

Progressive discipline typically starts with verbal warning of an infraction or unsatisfactory performance. If, after that warning, a boss thinks that the situation has not improved, it may be followed up with a formal warning in writing, then a suspension without pay and, finally, termination. The progressive steps of discipline reflect an increasing seriousness of infraction, or inability to improve following warnings and remedial supports. Lower levels of discipline might be accompanied by new training or counseling to help the employee improve. But—and this is a key point—while some matters might go through the entire progression of discipline, other more serious infractions might go straight to a higher level of discipline.

A vocal or demonstrative racist creates a hostile work environment for her coworkers, and can be punished—or even fired—under a system of just cause and due process. Let’s look at a few real-world scenarios. Casually browsing through arbitrators’ decisions in New York, we found the case of a professionally-classified employee at a social service agency serving developmentally disabled children and families, who made racist remarks about a supervisor to a fellow worker that other co-workers overheard. Horrified, the co-workers who were subject to an unwelcome racist rant reported it to management, complaining that they were not comfortable working with such an unabashedly racist co-worker. The racist employee was fired. She brought the case to arbitration, arguing that she was not given progressive discipline and was fired without just cause.

The case went all the way up to arbitration and a neutral third-party upheld the termination. The damning judgment: “Under these circumstances, I find that the Employer acted reasonably and had just cause to terminate Grievant’s employment. In maintaining a respectful, productive and safe working environment for a diverse workforce as well as a proper atmosphere for the Employer’s clientele, the use of certain negative language is beyond the pale and is unacceptable, making progressive discipline unwarranted.”

Amy Cooper, the entitled white lady who called the cops on “an African-American” birder in the Ramble of New York’s Central Park is a slightly more complicated case. Cooper was caught on video reacting in a reflexively racist way to a Black man who just wanted to protect some birds from getting gored by an off-leash dog, threatening to unleash some unpredictable police response upon him. She was quickly doxxed, and angry internet hordes demanded she be fired from the investment firm that she worked for. The firm, Franklin Templeton didn’t hesitate to fire her to protect its own reputation. But even Amy Cooper deserved due process.

The targeted campaign against the investment firm arguably made Cooper’s behavior in Central Park a work-related cause of damage to her employer’s business. More relevant is how uncomfortable her presence in Zoom meetings and on email CC lines would be for her co-workers in the immediate aftermath of her scandalous behavior. It would not be unreasonable for an employer to move directly to a suspension under those circumstances. It could be a suspension without pay while she cooled her heels and consulted with anyone willing to represent her in an appeal. If the employer decided that her time away from regular duties should be spent in implicit bias training or anger management counseling, then the suspension could continue some form of compensation.

If the goal of “cancel culture” is to “make racists afraid again” by making their despicable behavior carry real-world consequences, then Cooper very nearly losing her job would likely have been as effective as her actually losing her job. And under a just cause standard, she probably wouldn’t have been immediately fired for this one terrible offense.

Let’s look at one more example. In a widely-discussed piece for New York Magazine critiquing “cancel culture,” Jonathan Chait complained about the firing of a political data analyst named David Shor. In Chait’s telling, Shor tweeted a link to a paper by Princeton Professor Omar Wasow, which showed that non-violent protests increased the vote for Democrats, whereas protests viewed as violent increased the vote for Republicans. What followed was a Twitter debate between Shor and several others concerning the propriety of Shor posting the paper, wherein Shor was accused of racism and his employer was tagged. A few days later, Shor was fired from his job.

Chait uses the Shor episode, along with several others, to point to a “left-wing illiberalism” that seeks to silence people with opposing viewpoints. However, in Chait’s examples and his discussion of the problems, he almost wholly lets the employer off the hook. He engages in no discussion of at-will employment or how Shor’s employer should not have been permitted to fire him for a “superficially innocuous” tweet, but instead blames “leftists” and “the far left” for causing Shor to lose his job. Nowhere does Chait even mention that it was not the Twitter users who fired Shor, but his boss.

The problem for Chait was a “cancel culture” that included everyone except the powerful arbiter of speech who actually canceled his employment—his boss.

The cause must be just

In her 2017 book, Private Government: How Employers Rule Our Lives (and Why We Don’t Talk about It), University of Michigan professor Elizabeth Anderson argues that we think too narrowly about the power and ubiquity of “governments.” We almost exclusively focus on the power of the politicians we elect while ignoring the far more coercive power of our bosses. All workplaces have a system of government. In the United States, a unionized workplace is like a constitutional monarchy. We have some rights and can petition the King. A non-union workplace is a dictatorship. Left-wing activists need to think twice before appealing to the authoritarian power of a boss. Even if the cause of anti-racism is just, the boss’s arbitrary authority to punish his employees for what they do in their private time is a massive restriction of our civil rights.

Corporations are only temporarily embarrassed when right-wing employees spark a controversy. But corporations actually dislike left-wing ideas and are usually all-too-happy to find an excuse to quash them, leaving progressive activists far more vulnerable to campaigns of harassment targeted against their livelihoods. This can be seen in academia, where there has been a multi-year effort to police the speech of academics—on anything from the 1619 Project to the BDS movement—that’s viewed as too far left. Critics have tried to force risk-averse university administrators into firing such professors for tweets that get caught in the right-wing media echo chamber.

All workers deserve just cause protections, and we need to fight for this right as a matter of principle and self-defense. This can be done without endorsing an alliance with the boss that enshrines a broad unchecked power to fire at-will employees.

[This article originally appeared at In These Times.]