Now begins perhaps the biggest fight long-planned by the “Republican Revolution.” With his re-election and substantial majorities in both houses of Congress, not to mention a majority of states’ governors, Bush has more clout and more power than any Republican has had since Theodore Roosevelt. Social Security pisses off free market Republicans because it is one social welfare policy of the government that remains massively popular, despite 25 years “big, bad government” rhetoric. Of course, Bush is willing to risk his legacy over this fight. After Social Security goes the minimum wage, the rest of our Pell grants, Roe vs. Wade…

They really aim to repeal the twentieth century.

The plan, of course, reduces guaranteed benefits for future retirees. Workers can divert up to 4% of their payroll taxes to a limited number of government-chosen mutual funds, and, at retirement, must divert some of their money into an annuity which will supplement the reduced monthly benefit.

Immediately, Bush’s “base,” the banks and brokerage firms, will make a fortune on user fees on millions of mutual fund investments. Again, the government will limit the number of plans that workers can choose, and those plans will be administered by a small number of companies under contract from the government (presumably, “bidding” on these contracts consists of donating the most money to the most Congressional campaigns).

In the short term, Bush finally establishes the primacy of the market. Once we’re all investors, do we worry about the impact of environmental legislation, corruption investigations and union campaigns on the companies in which we are invested? Certainly, the Powers That Be and the pundits will remind us of these conflicts of interest at every opportunity.

Finally, Bush plants the seeds for Social Security’s eventual, final collapse. As less money goes into the SS Trust, even the lowered guaranteed benefits won’t be met, but, by golly, the money invested in the market continues to pay off for most retirees, and, so, some future president will propose that we finally scrap the outmoded government portion of Social Security and simply switch over to 401(k)s.

Ironically, I spent today opening my IRA, with money that I rolled over from my previous employer’s 401(k). I can see my future career rolling out before me: it’s a series of company pensions that I’m never around long enough to become vested in, and 401(k)s with tiny matching percentages. To be fair, my last employer’s 401(k) funding was very generous. Even so, I’ve never had any faith that this money, invested in the market, would be there for my golden years quite like Social Security is currently guaranteed to be.

Moreover, nothing can make one feel quite as powerless as putting one’s money and faith in a series of mutual funds. The literature you are given to consider the funds never fully lists the companies that you will be invested in. The power to take your money away from a company with whose ethics you disagree is reserved for people with so much money that they probably don’t care much about ethics anymore.

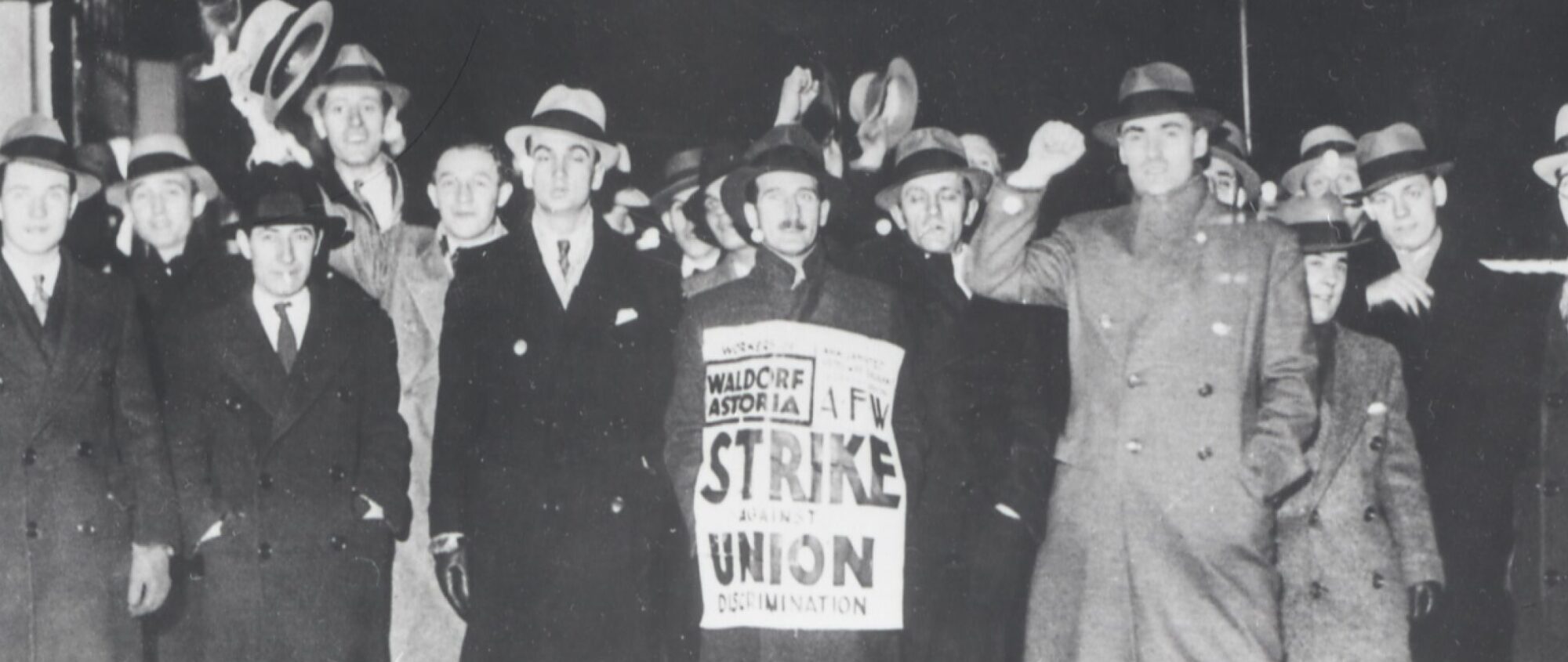

In his first term, Bush seemed able to ram through any tax cut or war that he wanted, so it’s easy to feel a sense of inevitability about Social Security privatization. But there’s more of us than them. Already, in the lead-up to the State of the Union, Bush took a drubbing from our quarters for “fuzzy math” and scaremongering. We can win. Take action. Stay informed. Get ready to take to the streets.